Popular posts from this blog

Helping check correlation trading

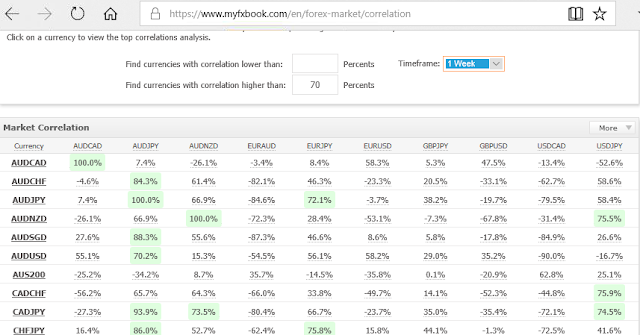

Helping check correlation trading The correlation is very animated in forex trading. It is easy to check what pair has high correlation with other or low relationship. There are many way to use correlation in trading but we recommend 2 significant rules: - Never buy 2 pairs have high POSITIVE correlation to avoid double exposure. In the below table correlation you easily see AUDCHF and AUDJPY what has 84.3% positive correlation. That means if you buy or sell both AUDCHF and AUDJPY, the risk will be most double if you are wrong. - Never buy 2 pairs have high NEGATIVE correlation to avoid unnecessary hedging. In the correlation table above, You could see AUDUSD and USDCAD has -90% negative correlation that mean if you buy AUDUSD and buy USDCAD you won’t have chance to have profit for that trade. We also highly commend trader should check the trend of these pair have high positive correlation with our Trend He...

Counter Trend Trading Setup

Counter Trend Trading Setup This counter trend trading setup take advantage of Potential Reversal Zone . This Algorithm trading find the high probability of reverse trend so we can use it to have the entry with good risk: reward. Potential Reversal Zone helps trader take profit or watch the order closely if the signal appear on the time frame or bigger time frame of trade. It also helps traders prepare for new trend and next entry. This set up content only 2 simple steps: - First step : Opening the Potential Reversal Zone to find the signal, we recommend to use signal of time frame H4 and D1 to trade. In this illustration, we have signal Buy for GOLD D1 after very long downtrend before. GOLD D1 has reversal signal for buy - Second step: After we have the sign of new trend, we will open Entry Opportunities to wait for the entry signal in time frame smaller: M15-M30-H1 ...

Comments

Post a Comment